- Bank Sakhi Reema Gupta has processed transactions worth over Rs. 20.83 crore in the past six years

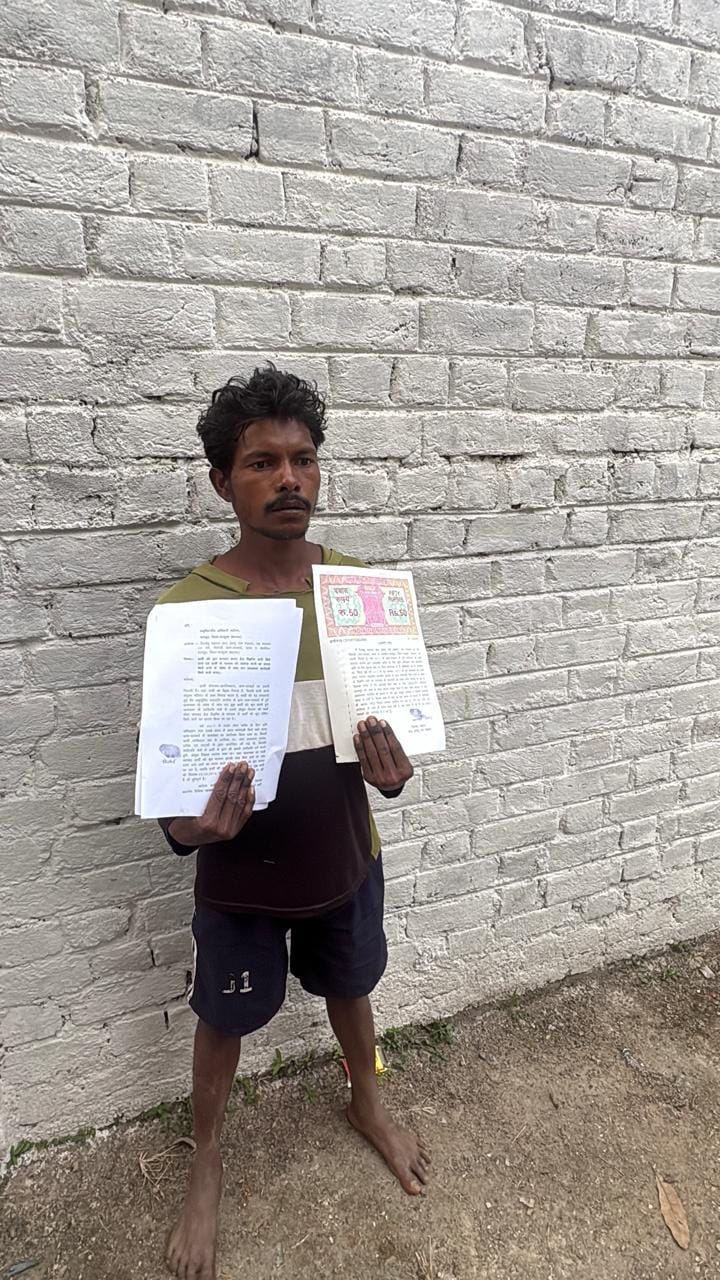

- Bank Sakhis are providing various banking services in villages, including disbursement of old-age pensions, disability pensions, etc

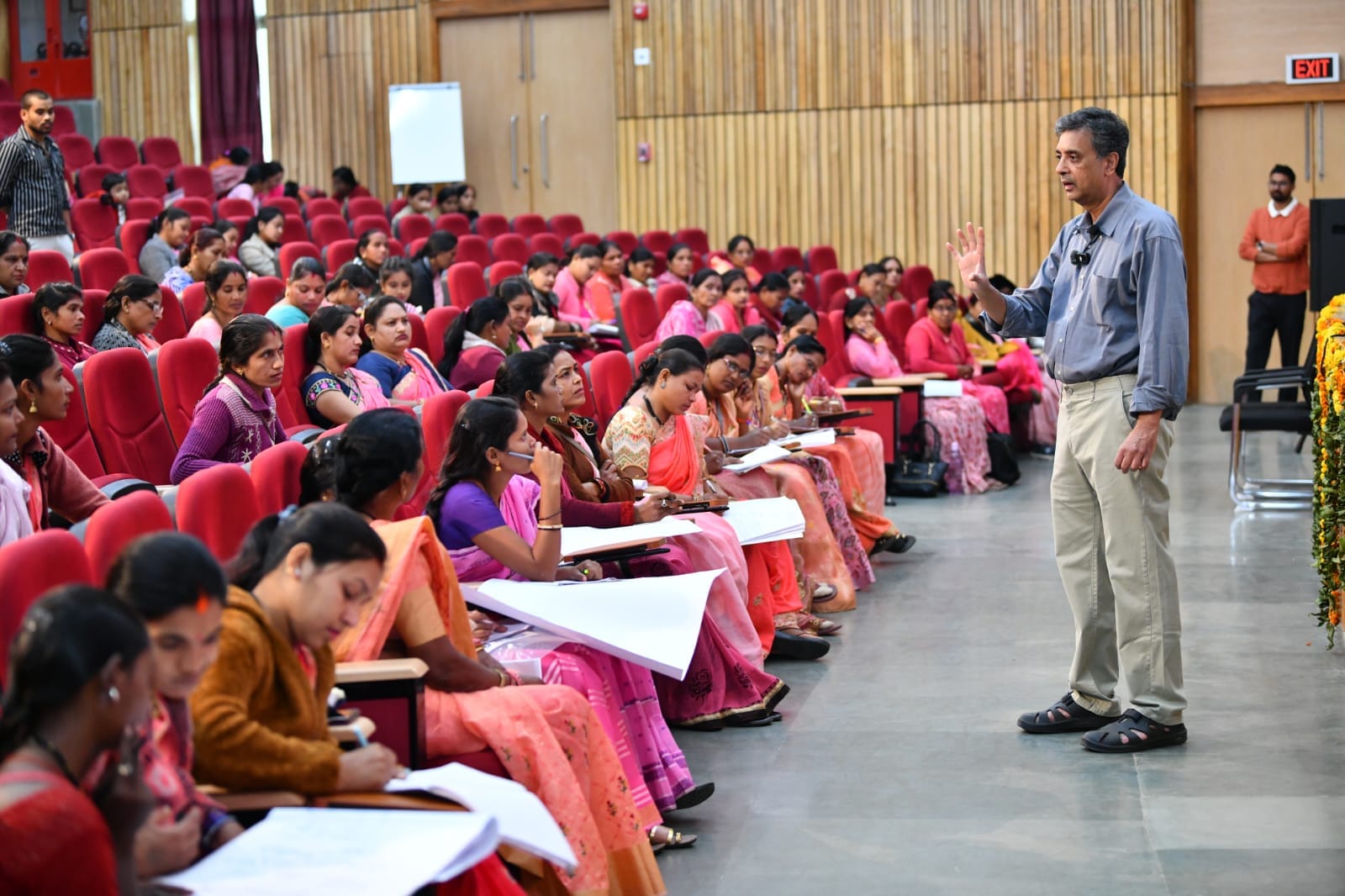

In a transformative shift for rural banking, women are stepping up as ‘Bank Sakhis,’ playing a pivotal role in delivering essential financial services right to the doorsteps of villagers. Traditionally, residents had to visit banks even for basic transactions, but now, these services are being brought directly to their homes. Bank Sakhis are not only extending banking facilities to rural communities but are also gaining financial independence in the process. They handle a variety of services, including old-age pension distribution, disability pensions, NREGA wage payments, self-help group transactions, and other routine banking operations. They are also instrumental in helping villagers open new bank accounts.

In Surguja district alone, 87 Bank Correspondent (BC) Sakhis are actively working across seven Janpad Panchayats, providing critical banking services to remote households. One notable example is Reema Gupta, a Bank Sakhi from Baneya Gram Panchayat in Sitapur, who has facilitated transactions worth over Rs. 20.83 crore in the last six years, benefiting more than 13,000 individuals. A graduate, Reema credits her father, a farmer, for ensuring the education of her and her four sisters. Her involvement with self-help groups in the village laid the foundation for her journey, where she worked as a group secretary, village organisation assistant, and cluster-level accountant. After learning about the Bank Sakhi initiative from National Rural Livelihood Mission (NRLM) professionals, she underwent training in Raipur and now serves as a BC Sakhi for the Chhattisgarh State Rural Bank, covering six gram panchayats, including Baneya, Hardisadh, Belgaon, Ulkiya, Sur, and Lichirma.

Reema’s journey as a Bank Sakhi has brought her not only financial independence but also personal satisfaction in helping others. With her husband engaged in farming and running a grocery store from their home, Reema’s work as a BC Sakhi provides additional income, enhancing their family’s financial stability. Through her kiosk, she has helped villagers open bank accounts, make deposits and withdrawals, and access benefits from various government schemes like the Pradhan Mantri Jeevan Jyoti and Suraksha Bima Yojanas. To date, Reema has opened 406 Jan Dhan accounts for rural residents. She has also enrolled beneficiaries in various insurance schemes, including 585 people in the Pradhan Mantri Suraksha Bima Yojana, 295 in the Pradhan Mantri Jeevan Jyoti Bima Yojana, 299 in the Atal Pension Yojana, and 45 in LIC policies. Her role as a Bank Sakhi generates a monthly income of Rs. 8,000 to Rs. 9,000, which has significantly boosted her family’s financial security.